How Chase Levitt Used Flippa to Build a $650K Digital Empire

Business Description

Table of Contents

Navigate through the case study sections

Executive Summary

Case Study Content

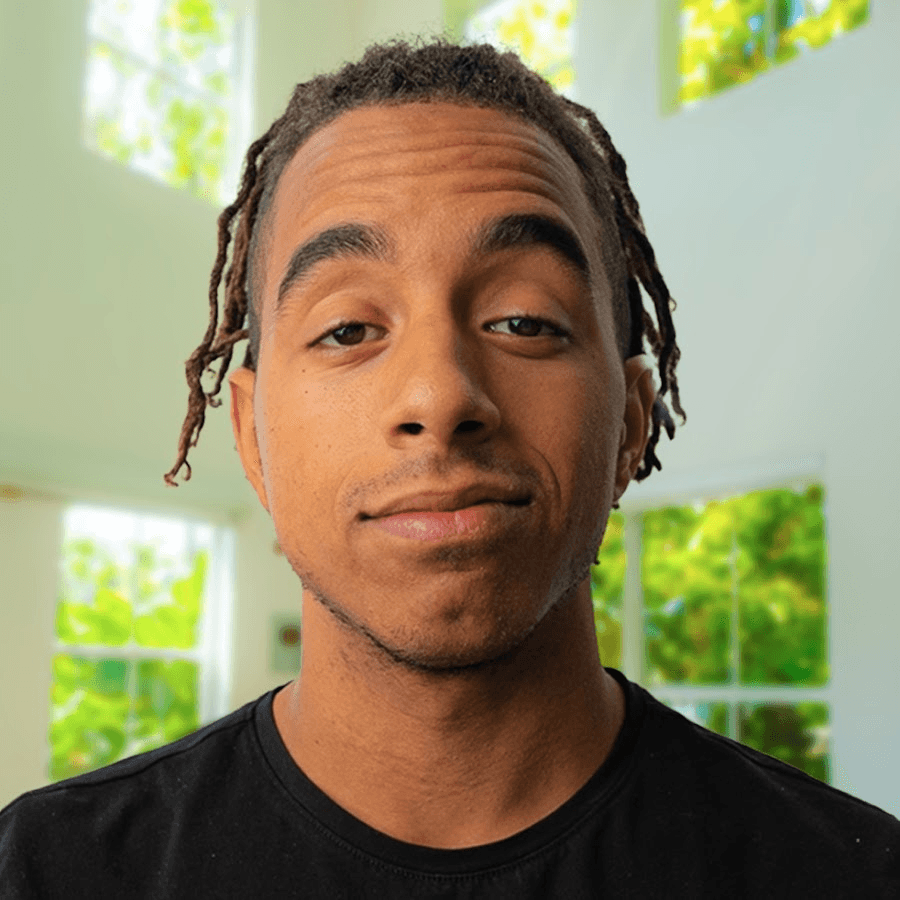

From Cautious Buyer to Serial Digital Entrepreneur: The Chase Levitt Story

In the digital age, building a multi-six-figure business no longer requires a Silicon Valley office or a ground-breaking idea. Sometimes, all it takes is shrewd analysis, nerve, persistence, and an eye for scalable assets. Meet Chase Levitt, a self-taught digital entrepreneur who turned $650,000 in acquisitions into a portfolio of online brands, relying on the Flippa marketplace as his engine for explosive growth.

The Breaking Point: Trading Security For Uncertainty

Back in 2017, life was comfortable for Chase. He had a steady job, covered his living expenses, and entertained the dream of business ownership, someday. That “someday” came at the intersection of dissatisfaction and research. Like most would-be founders, Chase’s early exploration was dominated by hesitation: Could he really stake his savings on a web-based business? Would the ROI be there, or would he waste years and a nest egg chasing vaporware?

First Buy: Amazon FBA and the Roll-up Play

Chase’s first purchase, an Amazon FBA ecommerce venture, became his introduction to ownership. He didn’t dawdle either. Gaining direct rapport with the seller, he learned to move fast; a casual inquiry could quickly turn into a lost deal if financing wasn’t ready. That sense of urgency, and the willingness to personally connect with sellers, paid off. Chase soon realized the value of the roll-up strategy: acquiring multiple smaller brands in similar verticals, then consolidating them under a single, more efficient operation. From logistics to marketing to product listings, scale gave him negotiating power and operational efficiency.

Facing the Grind: Opportunity Recognition Through Repetition

The real work wasn’t glamorous. Chase scrolled through 25+ businesses for every single promising lead. And, sure, some were vanilla or near-dead-on-arrival. “One in ten might have something left to accelerate, ” he explained. But that selectivity was everything. If there was still room for growth, and the niche aligned to Amazon or digital products, Chase pounced, never over-analyzing once the key metrics lined up.

Pivot to Digital: The Lightbulb Moment

Ecommerce is not for the faint of heart: inventory headaches, shipping snafus, supplier drama. After a string of wins and lessons in Amazon FBA, Chase reconsidered his model. A conversation with an author friend, struggling to finish his second book, sparked a revelation. Book listings behave a lot like product pages. But with digital goods, you avoid warehouses, shipping, and the gravity of unsold stock. This insight led Chase to purchase his first digital business on Flippa for $355,000, a bold move, but a calculated one informed by growing confidence and a craving for passive income.

Execution and Escalation: Buying, Integrating, Flipping

Momentum is everything. Within months, a second digital product brand was acquired for $195,000. Now running three companies at once, Chase found himself stretched: contractor management, SOP optimization, and day-to-day headaches tested his resolve. But this scale came with perks: cost efficiencies, bundled revenues, and, ultimately, a lucrative exit. Less than two years after his first move into digital goods, Chase sold the entire portfolio in a roll-up deal. The payout didn’t just change his bank account; it changed his outlook on work.

Lifestyle Ownership: Profits Into Freedom

With cash flow from his sale and a lean personal lifestyle, Chase redirected his focus. No longer burdened by the warehouse, he spent more time with his kids, without ignoring the online space altogether. Passive revenue from streamlined assets paid the bills, and new acquisition opportunities on Flippa meant he could cherry-pick brands with real upside.

Success Tactics: What Worked (and What Didn’t)

- Chase credits seller relationships as deal-makers: trust, speed, and direct communication regularly gave him a leg up.

- Financing readiness ensured he never lost a target to another fast-moving buyer.

- Focus on business stage: Only investing in companies still on their growth curve avoided buying someone’s “finished” project.

- Standard operating procedures (SOPs) made it easier to bolt on new acquisitions and maximize value right away.

- An eye for digital product models minimized staffing, logistics, and stress, letting him scale his portfolio without sleepless nights.

Why Flippa?

For Chase, Flippa’s value wasn’t simply in its inventory; it was about the direct line to motivated sellers, a curated newsletter matching his criteria, and a transparent marketplace. Competing platforms didn’t offer this blend of breadth and negotiation power. “The best part is the newsletter, it’s almost always what I want, and the auction access to speak directly with sellers. That’s tough to beat.”

Integrative Growth: Scaling Smarter, Not Just Bigger

After his first wave of sales, Chase leaned heavily on acquiring brands that could neatly integrate into his existing operation. Compatibility with his SOPs meant he didn’t have to reinvent the wheel every time, he just plugged new revenue into the machine. If a brand couldn’t be improved or consolidated, he skipped it, no matter how tempting the surface numbers.

Lessons Worth Sharing

- Be selective and patient: don’t jump at the first shiny listing.

- Have your capital lined up before engaging sellers.

- Prioritize businesses with untapped growth, not just stable past revenues.

- Build scalable SOPs: every new business should fit seamlessly.

- Make digital products a priority, higher margins, less operational baggage.

Conclusion: Personal Wealth, Family Time, and an Open Door for More

Chase Levitt’s journey is proof you don’t need to invent the next big thing to build wealth online. With patience, diligence, and some well-timed pivots, plus a platform like Flippa, any motivated buyer can transform online assets into a lucrative, flexible career. The key? Consistent criteria, speed in negotiation, and a willingness to adjust business models when the rewards are clear. Having handed operations off to high-performing SOPs and contractors, Chase now maintains passive cash flows, plenty of family time, and eyes new opportunities emerging each week in the Flippa marketplace.

Key Takeaways

- 1Chase Levitt acquired and scaled over $650,000 worth of online businesses using Flippa, proving that carefully-selected digital assets can outperform starting from scratch.

- 2Direct, rapid communication with sellers, and having financing lined up, was instrumental in landing acquisition deals ahead of the competition.

- 3Implementing a roll-up strategy allowed Chase to consolidate similar businesses, streamline operations, save costs, and boost profits.

- 4Switching focus from physical to digital products made scaling easier and more passive, freeing up time and eliminating logistics headaches.

- 5Chase only pursued businesses with real growth potential, applying strict selection criteria and integrating them into standard operating procedures for efficiency.

- 6The financial flexibility gained enabled Chase to prioritize family while staying involved with new ventures, showing success doesn’t require sacrificing work-life balance.

Tools & Technologies Used

Premium Content Locked

Subscribe to access the tools and technologies used in this case study.

Unlock NowHow to Replicate This Success

Premium Content Locked

Subscribe to access the step-by-step replication guide for this case study.

Unlock NowInterested in Being Featured?

Share your success story with our community of entrepreneurs.

Explore More Case Studies

Discover other inspiring business success stories

How Viral Vault Scaled to $90K/Month in SaaS

Viral Vault is a unified SaaS platform for Shopify store builders, offering product ideas, marketing assets, training mo...

Viral Vault

How John Rush Revived a SaaS Startup: From Acquisition Slump to 44% Revenue Growth in 20 Months

After buying Unicorn Platform for $800,000, John Rush saw a sharp drop in revenue and customer retention. Through system...

Unicorn Platform

How Joey Babineau Hacked Google Ads for $60K/Month

Affiliate marketer Joey Babineau spent over $3 million on Google Search Ads and now averages $60,960 a month in revenue....

Joey Babineau Affiliate Marketing