Streamline Your WooCommerce Accounting with Xero & SwipeHQ

Business Description

Table of Contents

Navigate through the case study sections

Executive Summary

Case Study Content

Case Overview

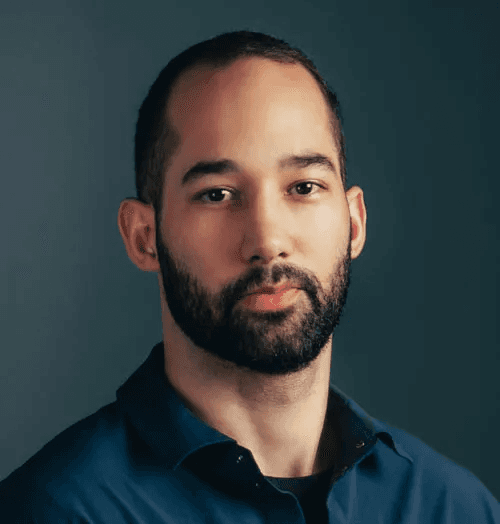

Dave Roberts runs a collection of small, niche e-commerce stores under his personal trading package in Auckland, New Zealand. Instead of investing in full accounting setups for each idea, he uses WooCommerce on WordPress to launch sites like Wishlantern and Modowest. As orders rolled in, manual bookkeeping became a drain on his time and energy. To solve that, he centralized his financial operations by connecting every store to a single Xero account with a low-cost WooCommerce extension.

On the payment side, Dave wanted a gateway that offered a smooth guest checkout without per-transaction fees. PayPal’s flat fee and account prompts led to abandoned carts, especially for low-cost products. SwipeHQ emerged as the best fit for his New Zealand market, with a straightforward pricing structure and faster settlements.

Challenges Faced

Before integration, every sale from each store required manual entry into a desktop accounting package. With three or four active sites at once, Dave spent up to four hours weekly on data entry. Exporting CSV files from WooCommerce, cleaning them up, and uploading into his old system felt like busywork. He knew there was a smart way to automate, but custom connectors quoted at over USD 1,000 per site made small trials unviable.

PayPal’s fee structure further cut into his margins. Each domestic payment carried a 3.4% rate plus a fixed NZD 0.45 fee, making low-ticket items less profitable. Guest checkout confusion also deterred first-time buyers who didn’t want to create a new account mid-purchase.

Implementing the Xero Integration

Dave chose the official WooCommerce Xero extension for USD 79, covering up to five sites. After signing up for a Xero trial, he installed the plugin on each WordPress dashboard. Under WooCommerce → Settings → Xero, he entered his API key and secret, then selected company tracking categories in Xero for each site.

The extension immediately started syncing orders as invoices in Xero. To ensure accuracy, he scheduled a quick QA phase: placing live test orders for NZD 1 on each site and verifying that line items, shipping amounts, and taxes mapped correctly. This gave him confidence to push the setup into production without disrupting customers.

After configuring each store, Dave ran live test orders—charging NZD 1 on each site—to confirm invoices appeared correctly in Xero. He checked line items, shipping amounts, taxes and customer details. This quick QA gave him confidence before flipping traffic live.

Configuring Sales Accounts per Store

In Xero’s Chart of Accounts, Dave created unique sales accounts with codes 200 for Wishlantern and 201 for Modowest. In the plugin’s Sales Account dropdown, he matched each store to its assigned account code. This mapping directed every sale to the correct ledger, giving granular reporting across all online shops.

Custom Invoice Numbering to Avoid Collisions

Since multiple stores sync to one Xero file, invoice numbers might clash. To prevent duplicates, Dave uses the Sequential Order Numbers Pro plugin. It lets him prefix order numbers with “W-” for Wishlantern and “M-” for Modowest. Now invoices show up as W-1023 or M-2045, making it simple to identify the source at a glance.

Setting Up the SwipeHQ Gateway

For payments, Dave prefers SwipeHQ over PayPal. SwipeHQ applies a flat processing rate without extra transaction fees and supports guest checkout flows. He installed the SwipeHQ Checkout plugin, entered his merchant API credentials, and adjusted currency and settlement options. Although he encountered two minor issues—a missing credit card field bug and a duplicate-billing during his first test—SwipeHQ’s phone support team resolved both in under 30 minutes.

Results and Advantages

Automation eliminated roughly four hours of manual bookkeeping each week. Orders now appear in Xero as invoices, fully detailed with line items, taxes, and payment status. With one centralized dashboard, Dave can instantly compare revenue across stores or drill down into an individual site’s performance.

Accurate, real-time data in Xero helps Dave set precise sales targets and decide which products to promote. Instead of waiting for end-of-month reconciliations, he checks daily dashboards to catch slow-moving items or capitalize on a sales spike. This visibility leads to smarter marketing spend and optimized inventory replenishment.

Concluding Thoughts

This plug-and-play accounting setup shows that small e-commerce experiments can stay nimble and efficient. By combining WooCommerce, Xero, and SwipeHQ, Dave built a scalable system that tracks multiple stores for under USD 100. No custom coding, no spreadsheets, just cloud-based simplicity.

Looking ahead, Dave plans to combine his Xero data with Google Analytics into a unified dashboard. He’s also exploring Xero’s automated tax reporting to handle GST filings without extra spreadsheets, further trimming busywork from his side projects.

Key Takeaways

- 1Gives unique Xero account codes per store for instant performance tracking across multiple sites.

- 2Automates order syncing from WooCommerce to Xero, eliminating manual data entry and reducing error risk.

- 3Custom invoice prefixes prevent numbering collisions when multiple stores send invoices to one accounting file.

- 4SwipeHQ’s flat-rate processing and guest checkout improve customer experience and reduce fees on low-value orders.

- 5Cloud-based setup requires under USD 100 in initial fees, with no need for expensive custom integrations.

- 6Real-time financial data enables smarter marketing decisions, accurate sales targets, and efficient inventory planning.

Tools & Technologies Used

Premium Content Locked

Subscribe to access the tools and technologies used in this case study.

Subscribe NowHow to Replicate This Success

Premium Content Locked

Subscribe to access the step-by-step replication guide for this case study.

Subscribe NowInterested in Being Featured?

Share your success story with our community of entrepreneurs.

Explore More Case Studies

Discover other inspiring business success stories

Arc’teryx Alpine Academy’s Rapid WooCommerce Launch

Arc’teryx Alpine Academy needed a scalable, multilingual registration system that could handle hundreds of simultaneous ...

Arc’teryx Alpine Academy

How Rezi’s AI Resume Builder Scaled to $215K Monthly

Rezi began as a $9.69 Word template sold by founder Jacob Jacquet straight out of college. Since May 2015, he’s refined ...

Rezi

How Kokatat Transformed Its Ecommerce with BigCommerce

Kokatat, a heritage paddling-apparel brand, moved off Magento onto a composable BigCommerce and Contentful stack. By she...

Kokatat