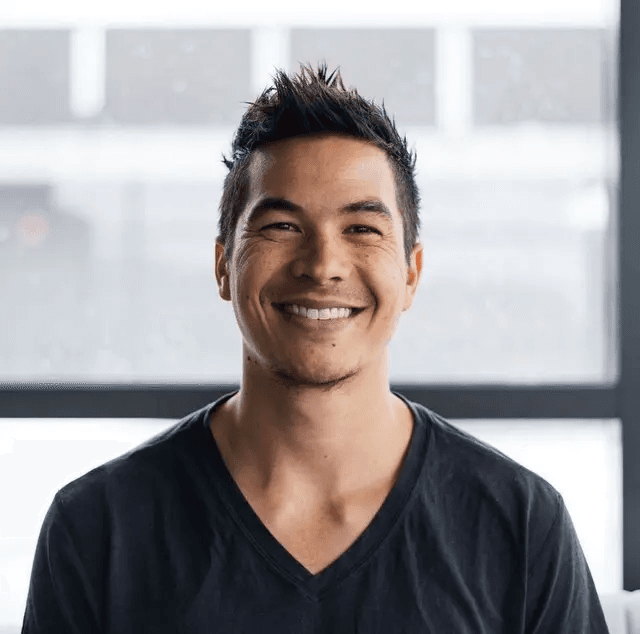

Inside the 2024 Online Business Boom: Greg Elfrink’s Strategy

Business Description

Table of Contents

Navigate through the case study sections

Executive Summary

Case Study Content

Market Conditions in 2024

After a sharp downturn in 2022 and a wave of fund closures in 2023, 2024 has brought a more measured return of buyers to the online business marketplace. Buyers are no longer chasing volume at any cost. They’re zeroing in on businesses with predictable cash flow, clean data control and clear growth paths. Sellers, meanwhile, face a higher bar: consistent revenue streams, diversified channels and solid customer relationships are now essential to attract offers.

Google’s Algorithm Shake-Up

Recent updates have driven some content sites to the brink, with organic traffic plunging and ad revenue drying up. Many site owners are selling fast or pivoting toward e-commerce and SaaS add-ons. E-commerce stores and SaaS platforms, with direct customer ties and multiple acquisition channels, have largely escaped the worst hits. It’s a warning that relying on a single traffic source can leave a business vulnerable to platform changes.

Selling a Declining Business

Distressed assets are in low demand, and buyers expect discounts or deferred payments. If traffic and revenue have dipped, prepare for a lower multiple and a deal where a portion of the payout is tied to future performance. Highlight fixable issues, untapped channels and quick wins to make a turnaround story more appealing.

Models on the Rise

Marketing agencies and direct-to-consumer e-commerce stores (beyond dropshipping) are drawing strong interest. Agencies offer recurring revenue, scalable teams and clear growth levers. D2C brands own their supply chains, pricing and customer data, giving them resilience against market shifts. SaaS businesses remain sought after, though competition is tough for top-tier companies.

The Seller Financing Surge

With bank lending still tight, seller financing has become a standard part of deal structures. Sellers often take 50–70% up front and carry the balance over 1–3 years, sometimes with performance-based earn-outs. Buyers gain access to larger deals while sellers benefit from higher total sale prices and potential tax advantages.

Tips for Buyers

- Set a clear acquisition budget, including working capital.

- Match the target business to your core skills and experience.

- Develop both short-term operational plans and long-term exit strategies.

- Assess industry trends and risks, from regulatory moves to platform dependencies.

- Use deal structures like earn-outs to protect capital and align incentives.

Preparing to Sell

Start planning 12–18 months before you list. Clean up financials, document processes and build a team that can run without you. Accelerate growth, diversify revenue and get a vetted valuation. Stay engaged until closing, buyers pay up for momentum, not decline.

Conclusion

2024’s online business market rewards quality and preparation. Whether you’re buying or selling, focus on stable revenue, multiple traffic sources and smart deal terms. With a cautious buyer pool and evolving models, the winners will be those who know their numbers, understand market shifts and structure deals that balance risk and reward.

Key Takeaways

- 1Buyers in 2024 focus on businesses with stable, predictable revenue and direct control of customer data.

- 2Content sites face steep algorithm penalties; e-commerce and SaaS models offer more resilience.

- 3Distressed businesses require realistic pricing, creative deal structures, and a clear turnaround narrative.

- 4Marketing agencies and branded D2C stores are top targets thanks to recurring revenue and owned channels.

- 5Seller financing, 50–70% upfront with deferred payments, has become a common way to bridge lending gaps.

- 6Thorough due diligence, matched skill sets, and clear growth and exit plans are vital for buyers.

Tools & Technologies Used

Premium Content Locked

Subscribe to access the tools and technologies used in this case study.

Unlock NowHow to Replicate This Success

Premium Content Locked

Subscribe to access the step-by-step replication guide for this case study.

Unlock NowInterested in Being Featured?

Share your success story with our community of entrepreneurs.

Explore More Case Studies

Discover other inspiring business success stories

How Unsplash Built a Free Photo Powerhouse with Community-Driven Growth

Unsplash began as a side project sharing surplus high-res photos on Tumblr. Rapid viral uptake on Hacker News sparked a ...

Unsplash

How Erik Cagi Earns $12K+/Month with Spanish Course Ads

Erik Cagi, a solo affiliate marketer, discovered a high-converting angle in the language niche with Synergy Spanish. By ...

ErikCagi

How DueDilio Turned M&A Pain Points Into a Thriving Marketplace

DueDilio was created after Roman Beylin’s own small-business acquisitions highlighted how slow and complex assembling an...

DueDilio